Weekly Market Momentum

SPY Stalls Beneath Trendline — Structure Tightens, Bulls Hold Control

Published on: 18/01/2026

SPY continues to compress beneath the rising weekly trendline, with bulls still holding control but momentum beginning to fade. Daily structure shows signs of pressure building — will buyers step in again, or is a pullback coming first?

SPY Weekly Outlook: Structure Intact as Price Grinds Higher

Published on: 11/01/2026

SPY continues grinding higher into January with bullish structure intact. Momentum is cooling, but this is not a top — focus on leaders and clean setups.

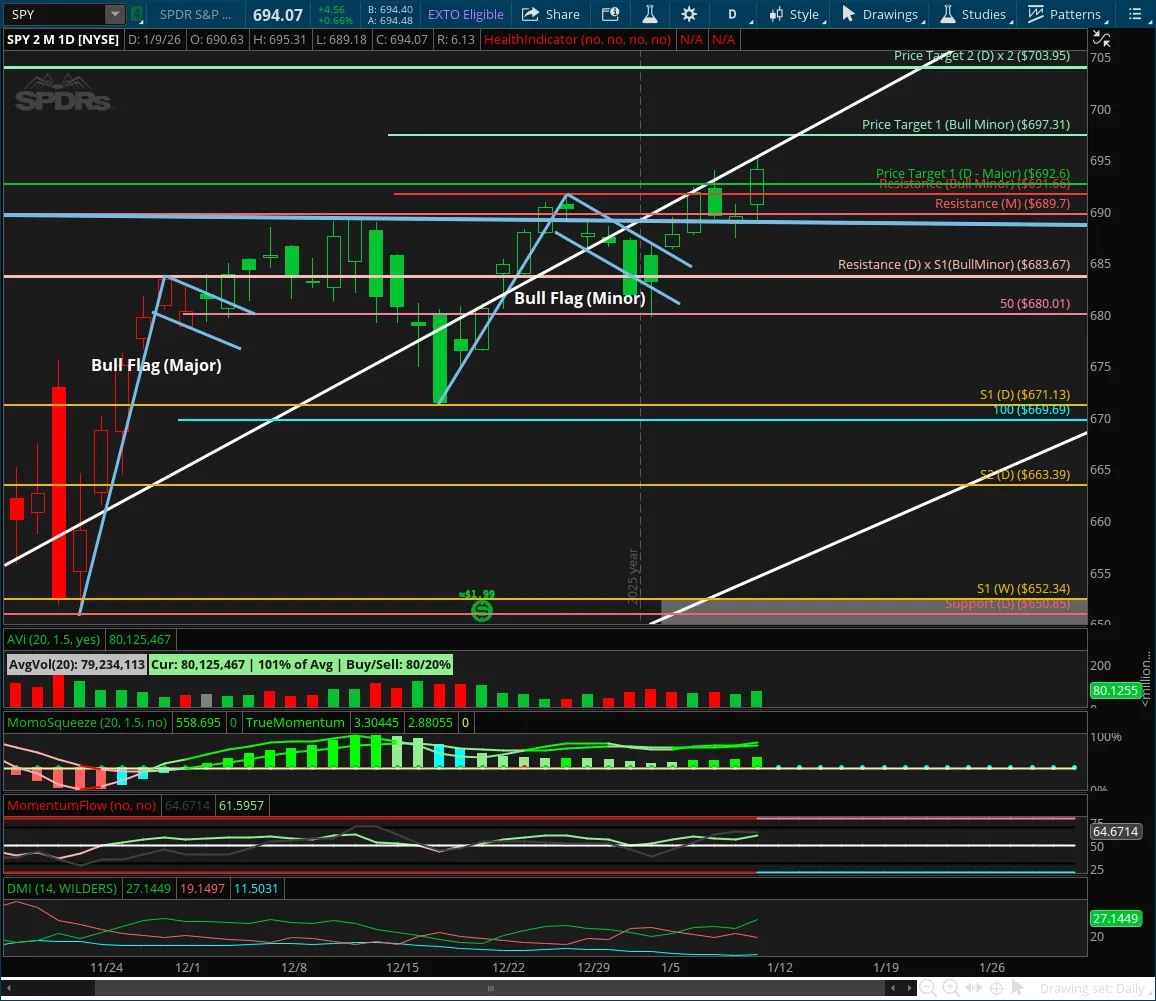

SPY Breakout Rejected — Why Patience Matters Here

Published on: 05/01/2026

SPY failed to hold its daily breakout and is now resetting near the 50SMA. Momentum has rolled bearish, signaling choppy upside and a likely structure reset.

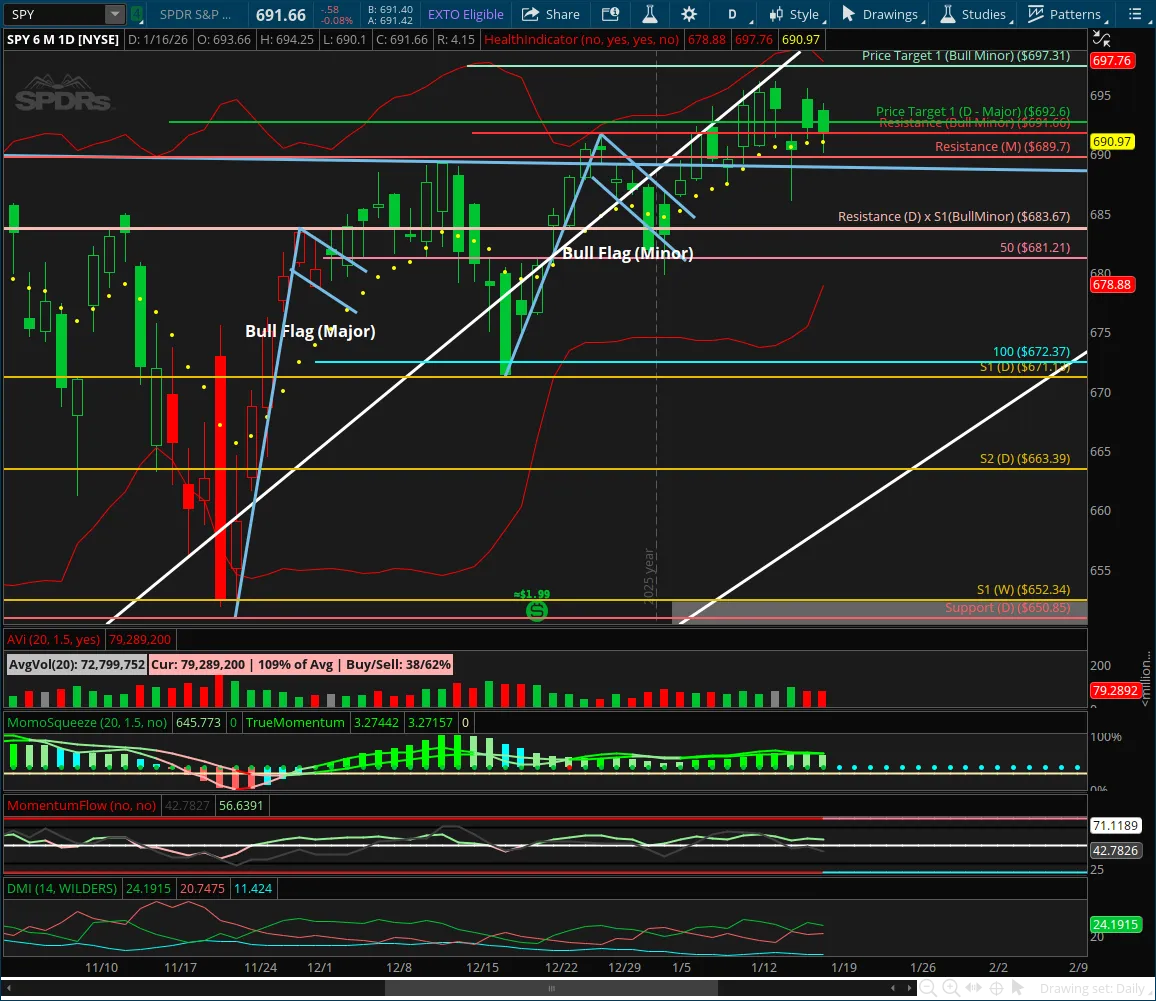

SPY Presses Toward Highs as Momentum Tests Resistance

Published on: 29/12/2025

SPY is compressing into a tight structural coil with momentum building beneath the surface. This analysis breaks down key levels, dominant trends, and what to watch before the next decisive move.